What Are The Possible Reasons For Claiming Refund?

Using IRS Form 8849, you can claim refunds using the below schedules -

Schedule 1

- Nontaxable Use of FuelsSchedule 2

- Sales by Registered Ultimate VendorsSchedule 3

- Certain Fuel Mixtures And Alternative Fuel CreditSchedule 5

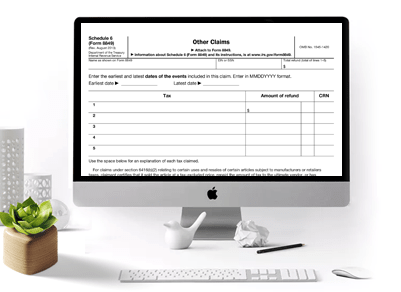

- Section 4081(e) ClaimsSchedule 6

- Other Claims Including Credit Claim From Form 2290Schedule 8

- Registered Credit Card Issuers